The classic 60/40 portfolio—comprising 60% stocks and 40% bonds—has long been at the core of modern asset allocation strategies. It was established based on Harry Markowitz’s Modern Portfolio Theory in the 1950s and came into broader institutional use after the introduction of ERISA (the Employee Retirement Income Security Act) in 1974. However, the 60/40 portfolio truly gained popularity starting in the 1980s, when interest rates began to decline. The combination of high stock returns and bond stability created a near-perfect balance, making it the most trusted asset allocation strategy among both individual investors and pension funds for decades.

Performance: Proven returns and stability

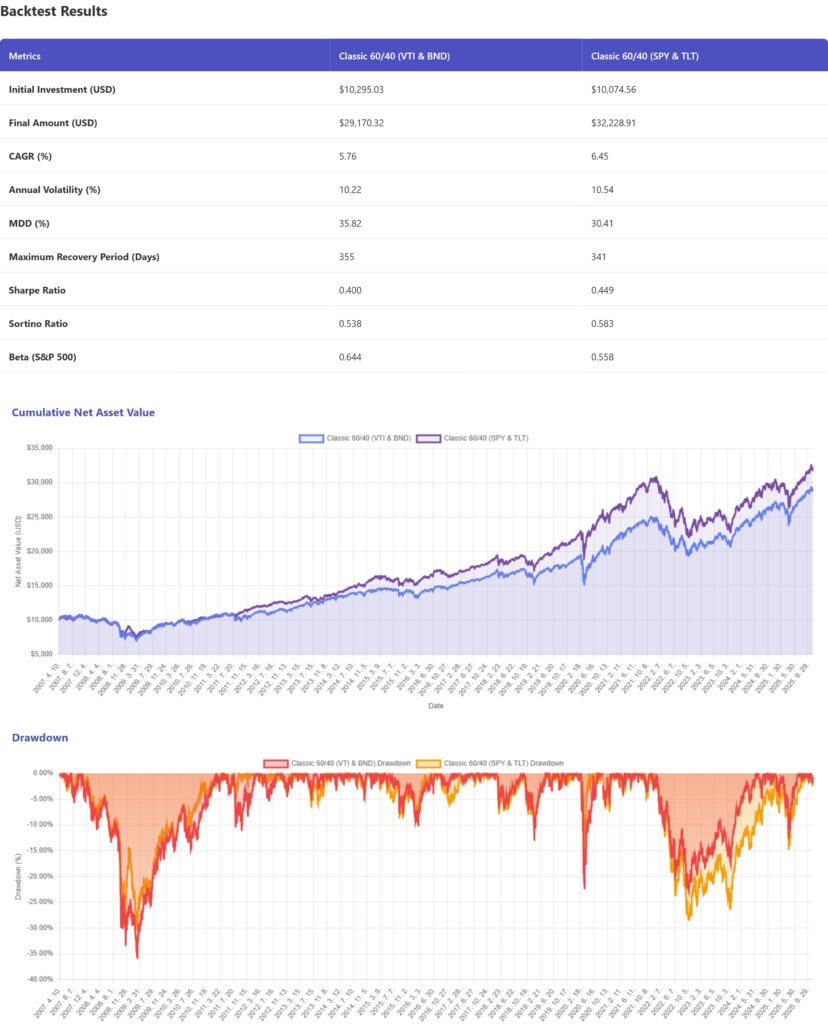

The greatest strength of the 60/40 portfolio lies in its proven track record. Over more than 25 years of data since 1997, this strategy has delivered an average annual return of 6.8%. Even during periods of extreme market volatility, such as the 2008 financial crisis, its losses were reduced to roughly one-third of those experienced by an all-equity portfolio.

The Guiding Principle: Rebalancing for Stable Returns

The reason the 60/40 portfolio has remained so popular is that it is built on a clear operating principle. At the heart of this strategy is maintaining a predetermined asset allocation ratio through rebalancing. When stocks surge and their weight rises to 70%, the excess portion is sold and the allocation is brought back to 60:40. This simple rule-based process provides two key advantages.

First ,This automatically puts into practice the investment principle of “buying low and selling high.” By trimming gains from assets that have risen and buying more of those that have fallen, it maximizes returns over the long term. Second, it helps prevent emotional investment decisions, because it forces you to maintain target weights mechanically rather than being swayed by market conditions. While frequent rebalancing can help keep your asset allocation close to the target, higher transaction costs mean it does little to improve overall returns. Rebalancing once or twice a year is generally the most reasonable approach.

Diversification: A broader mix of regions and strategies makes your portfolio even more resilient.

You can further reduce risk by adding international diversification to a basic 60/40 portfolio. This means allocating part of the 60% US equity sleeve to developed and emerging market stocks, and including global bonds rather than holding only US bonds. For example, replacing VTI with VT can enhance the benefits of global diversification.

You can also add a small allocation (5–10%) to real estate (REITs) or dividend stocks to create an additional income stream and provide some protection against inflation. The key to effective diversification is selecting assets with low correlations to one another. Because stocks and bonds tend to have low correlation, combining them can reduce overall portfolio volatility by 20–30%, and the more truly distinct assets you blend, the lower the risk of extreme losses becomes. However, adding too many holdings can actually dilute returns. The right mix of assets will ultimately depend on each investor’s individual circumstances.

Asset Allocation: Recommended ETFs

The most efficient way to build a 60/40 portfolio is to use low-cost index-tracking ETFs. One of the most widely used combinations among global investors is a mix of VTI (60% equities) and BND (40% bonds), which together have a blended expense ratio of just 0.07%. As shown in the table above, a portfolio of large-cap stocks (SPY) and long-term Treasuries (TLT) has delivered better results in terms of average annual return and maximum drawdown than a portfolio that simply owns the entire US stock and bond markets. This is likely because SPY and TLT exhibit a stronger negative correlation. The fact that the US market has been driven largely by large-cap stocks over the past 20 years may also have contributed. If you use lower-cost ETFs such as SPLG and SPTL instead, the combined expense ratio drops to an extremely low 0.024%.

한국에 상장된 ETF에 투자를 한다면 ACE 미국S&P500과 ACE 미국10년국채액티브가 있습니다. 한국에 상장된 ETF중 환노출이 되면서 미국 장기채에 패시브로 투자하는 상품은 현재 없습니다. 액티브 ETF가 싫다면 선물에 투자해야 합니다.

If you don’t even want to worry about rebalancing and simply want to keep accumulating a single ETF, one option is the iShares Core Growth Allocation ETF (AOR). This fund automatically maintains a 60/40 split between equities and bonds, investing primarily in US stocks, US bonds, and a portion of international assets. Its expense ratio is slightly higher at 0.15%, but in return, you can just keep buying it and focus entirely on your main work without having to manage the portfolio yourself.

Minimum Investment: Setting a Practical Starting Point

You can comfortably start a 60/40 portfolio with as little as around 5,000 USD since US ETFs like VTI trade at roughly 100 USD per share.

However, once you factor in regular rebalancing and trading costs, it becomes more reasonable to start with at least around 10,000 USD. With this level of capital, you can minimize the impact of transaction fees and manage the portfolio more efficiently within tax-advantaged accounts such as personal pensions or retirement plans.